How to Prevent Direct Deposit Fraud: Best Practices for Employees and Employers

A way to prevent this scheme is by having separate individuals submit withholdings and another individual review the contribution statements. You may get a false payslip showing that Income Tax and National Insurance contributions have been deducted. However, this may be different to what HMRC has been told, and it is often not paid. The checks you need to take will depend on what your business does, and how it operates.

Workers’ Compensation How It’s Done

It should be mentioned that under this Act, all benefits are provided in cash. The Act also establishes a Corporation, a Committee, and a Council, among other things, to carry out the Act’s provisions. The Supreme Court upheld the decision of the Single bench with the observation that the evidence produced before the Court were sufficient to justify the action taken against the illegal appointment of the workmen. The workmen had taken a contradictory stand at different stages, which suggests that their appointment was not bonafide and the appointments were done in contravention to the requirements of 1959 Act.

Implications for Employees

The relaxed rules for obtaining funds and the expanded aid to independent contractors who couldn’t confirm employer or income information complicated the verification process. Outdated online unemployment systems with obsolete software were unable to handle the unusually high volume of claims. Frozen or slow databases impeded the ability of benefits administrators to cross-check information. Embezzlement occurs when an employee takes the personal property entrusted to them.

Clocking on and off at different times

An IP PIN is a six-digit number that prevents federal tax returns from being filed in the names of identity theft victims. The IP PIN is a voluntary program open to any taxpayers who can verify their identities. Besides taxpayers, accountants and other tax professionals have also been a target of IRS enforcement activity. The IRS has the authority to impose civil penalties on alleged promoters under Internal Revenue Code Section 6700. DOJ may pursue criminal cases against individuals and entities it believes employer payroll frauds are promoting false ERC claims. This enforcement activity may even target individuals or principals of a firm after it has long ceased operations.

- Organize performance reviews to occur personally with all employees on the payroll register, not organized by particular sites or groups.

- Understanding whistleblower protections is essential, as these laws safeguard employees from retaliation for reporting suspicious activities.

- According to the Association of Certified Fraud Examiners, a typical payroll fraud scheme lasts 24 months.

- Shell companies (or shell corporations) have no real operations and are simply “created to hold funds and manage another entity’s financial transaction” (SmartAsset).

- These audits should include a thorough review of payroll records, employee classifications, and timekeeping systems.

An employee with access to the employee records can create and adjust the employee file to overcome these problems. This problem is also overcome if the ghost is a part-time or casual employee and only stays on the system for a limited time, before leaving CARES Act and being replaced with another ghost. Educating staff about the various forms of payroll fraud and the red flags to watch for can create a vigilant workforce that acts as the first line of defense.

Leveraging Data Analytics to Uncover Fraud

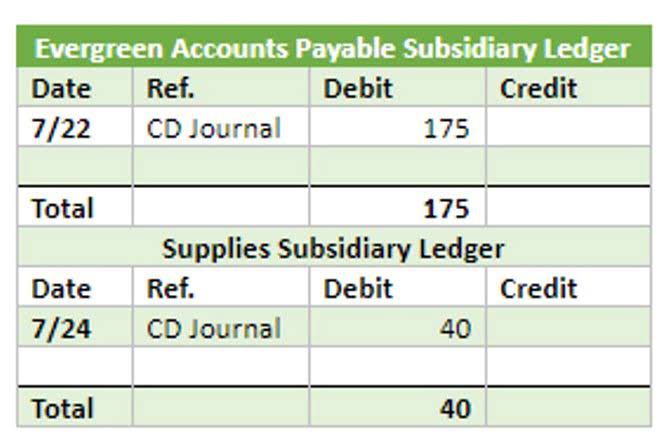

These reviews often highlight abnormalities that automated systems can miss, like payments made to terminated employees or unexplained shifts in overtime. Employers Accounts Payable Management found guilty of wage theft in Mexico face severe legal consequences, including fines, back pay, and penalties. Legal actions can be taken by employees to recover stolen wages and seek damages for the illegal actions of their employers.

Sick leave fraud refers to an employee falsely claiming sick pay from their company while working in another job. In one case, a Boston police captain was found guilty of an overtime scheme where he inflated and approved his team’s overtime hours, resulting in himself and his unit being paid twice as much. This scheme of his went on for 3.5 years before he was caught and resulted in a large loss of money for the police force. Unfortunately, this type of fraud can go on for a very long time if it is not caught early on or if a company doesn’t have the right policies in place to prevent it from beginning.

- To avoid being caught, employees overlap customer accounts, using one account to cover the stolen money from another.

- If you are reading this at a later date you are advised to check that that position has not changed in the time since.

- The tenant specifically told the building manager that keycard records for a four‑month period showed that the supervisor worked fewer than four hours on more than half of the days he was present.

- By ensuring that no single individual has control over all aspects of the payroll process, organizations can significantly reduce the likelihood of fraud.

- Misclassification also skews tax contributions, as seen in Australia’s 2024 reforms mandating retrospective benefits for workers.

- Essential workers risking personal safety and working endless hours to save lives.

Employees clock in and clock off when they arrive and leave work, either by inserting a timecard into a time-stamping machine attached to a clock, or swiping an electronic card over a reader . Time clocks are generally used where employees are paid on the number of hours worked and their shifts vary from time to time. The best prevention technique will be a system of controls requiring detailed reimbursement requests, original receipts, supporting documentation and reasons for that expenditure is necessary. This verifies the legitimacy of the claims and limits the chances that a second claim for the expense will be made at a later date. Altering receipts or documentation is making changes to the original document evidencing the expense.