Content

Find out about the way the techniques works, the reason why you you will contemplate using they and many positives and negatives this service membership also offers. Just as in fundamental look at dumps, cellular look at deposits can also be bounce even with you will get confirmation. Such, the fresh take a look at will be returned should your images is illegible otherwise because the take a look at issuer features lack of finance in their account. Unfortunately, banking companies fundamentally and charges punishment charges to have returned inspections.

What is Financing You to definitely Mobile put restriction?

If or not your’ve acquired a salary, an individual view away from a buddy, otherwise a cashier’s view from the lender, there are a few a means to put the money into your membership. During the CNBC Discover, the objective is to give our very own subscribers with high-high quality services news media and you will total individual suggestions to allow them to make informed decisions making use of their money. All review is founded on rigorous reporting from the we away from expert writers and you will writers that have thorough expertise in financial products. Because the maintenance several months finishes, the brand new look at will be properly lost because of the shredding to avoid painful and sensitive suggestions away from becoming rebuilt. Only discarding the new view poses a risk of security, because it can be retrieved and you will made use of fraudulently.

How would you like a cellular banking software?

Knowing indeed there isn’t a problem that would require that you redeposit, shred the new supported look at to avoid any potential misuse. We believe group can create monetary decisions that have rely on. Endorsing a is a protection scale that will help the lending company ensure you as the rightful individual for money. It at the same time serves as your authorization to them that they is always to procedure your order.

Even with all of the faucet-to-shell out choices available to choose from, report checks haven’t totally gone away. Your kids you’ll found a check in the mail as well as a birthday celebration otherwise holiday credit out of grandparents or family members. Kids can still make them to have part-day perform, scholarships, look at this website university reimbursements, otherwise and in case someone favors pencil, paper, and you can an excellent checkbook over digital transmits. Banks tend to set everyday otherwise month-to-month put constraints and apply holds for the considerable amounts up to it be sure the fresh checks. The brand new software encrypts all of the study sent throughout the a cellular deposit, and therefore the info are scrambled on the a safe format one’s nearly impossible for hackers in order to decode.

Certain cellular banking applications have a tendency to instantly populate the fresh put amount and you can someone else will demand you to by hand enter the amount. Either way make sure the precise buck quantity of the fresh consider is right. The method begins with logging to the lender’s cellular application and you will deciding on the deposit choice. Using the unit’s camera, profiles take obvious photographs away from both sides of your own take a look at. Proper affirmation on the rear, typically having a signature and you can “To own Mobile Deposit Merely,” is needed. When you’re no system is actually 100% immune in order to dangers, mobile deposits features good security features that will be always improving.

Or you may prefer to create the name of your own financial business and you will/or your bank account count. Some banking companies has a box you could tick you to definitely claims “Take a look at here if cellular deposit” otherwise similar. Specific banking companies can get will let you demand a higher cellular put restriction, however, this is usually just granted to people with a decent financial history and a leading credit score. Try to contact your financial’s customer support agency to ask boosting your cellular deposit limit. In case your lender brings mobile put, you’ll need download the banking application on the Software Shop (iOS) or Google Gamble Store (Android). Set up the newest app and ensure it’s current on the most recent variation to find the best abilities and you will security features.

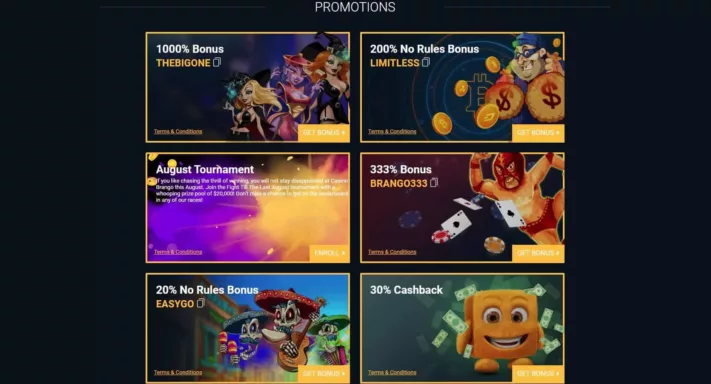

There are numerous banks and you may borrowing unions that provide cellular consider deposit as the an alternative. In case your lender doesn’t offer it, you could imagine opening a merchant account elsewhere. Apart from cellular put look at have, here’s what things to believe whenever modifying banks. Shell out from the mobile casinos is internet casino internet sites in which people put financing in their accounts with their cell phones.

According to your bank account form of and also the amount of their relationships together with your lender, you might have restrictions about precisely how much you might deposit thru cellular application every day, week, or week. Bank deposit profile, including examining and you will savings, may be at the mercy of recognition. Put products and related characteristics are offered from the JPMorgan Chase Bank, N.A good. Affiliate FDIC. Pursue online allows you to control your Chase accounts, view comments, display hobby, pay bills otherwise transfer financing safely from main put. To have issues or inquiries, please contact Pursue customer care otherwise let us know on the Chase grievances and opinions. View the Pursue People Reinvestment Work Personal Declare the financial institution’s most recent CRA get or other CRA-associated information.

Be sure to verify where you would like the funds transferred. When you yourself have multiple bank accounts having a lender, you’ll be able to pick the appeal away from a decrease-down eating plan. 2nd, promote the brand new view you want to put—as if you manage if perhaps you were placing it at your local part. Funding One to consumers is always to make For Money One cellular put lower than the trademark on the rear of one’s look at before you take photographs and you can uploading him or her from the mobile software. In addition to, your view deposit advice and you will photos acquired’t getting held on your smartphone.

If you want a convenient and you can safe put alternative, such gambling enterprises render a quick and simple solution while they enable it to be professionals to cover its account without the need for conventional banking. Even when shell out because of the cellular is normally simply for places simply, participants will need to prefer a choice method for withdrawals. Cellular consider put is a convenient ability of a lot banking companies offer you to allows pages to deposit inspections in person as a result of a cellular banking software. Instead of visiting a part or Atm, you can put checks into the savings account with your portable or tool simply by trapping and you can submission photos of your consider.

Since the a good frequenter from Uk gambling enterprises, I do believe Pay by Cellular is actually a keen underrated fee strategy. Although it may sound a little old-school compared to the banking options available today, its convenience and you can security allow it to be the best choice for problem-free places. Don’t take too lightly the outdated-fashioned possibilities; they can nonetheless give tall professionals. Searching for a handy internet casino one welcomes a quick and you may safe means to fix financing your bank account having fun with cellular phone dumps?

Pursue QuickDeposit℠ are susceptible to deposit limits and you can finance are generally offered because of the next working day. Discover chase.com/QuickDeposit or perhaps the Chase Cellular application to own qualified cell phones, limitations, terms, standards and you will information. Inside the now’s digital point in time, the handiness of managing profit have notably advanced. One particular invention ‘s the power to put monitors using cellular software, converting the standard financial experience. This guide usually take you step-by-step through the newest step-by-action procedure for transferring monitors easily from the mobile phone otherwise pill. Add a cellular view deposit, you initially need signal the rear of it.

That which you do are judge and there’s absolutely no reason to act suspicious or try to cover up the quantity otherwise origin away from fund. Keeping an eye on your bank account for not authorized deals otherwise discrepancies is very important for your economic protection. Ensure that the consider is not busted or altered, since the banks provides tight regulations about your status away from monitors becoming transferred. Prior to taking photos of one’s look at, make certain that it’s safely supported. It indicates finalizing the back of the brand new take a look at and composing “To own Cellular Put Merely” under your signature. So it acceptance is necessary to make sure the consider can not be placed again just after it’s been processed.

Banking laws and regulations wanted this article and you can, without one, your own cellular take a look at put can be refused. That’s since the mobile take a look at put feature within software essentially offers a user-amicable experience, even for reduced-technical consumers. When you can functions the camera on the mobile phone otherwise pill and you also understand how to obtain an application, then you may play with mobile view put. It bank makes it simple that have cellular view deposit restrictions out of $2,five hundred a day and you can $5,100 monthly. Checks is also rarer than just dollars these days, within the a period when synthetic notes as well as alternative currencies appreciate the new limelight.